15+ mortgage ratio

Web Your front-end or household ratio would be 1800 7000 026 or 26. Web Mortgage lenders use the debt-to-income ratio to evaluate the creditworthiness of borrowers.

:max_bytes(150000):strip_icc()/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional What S The Difference

However conventional loans may allow a DTI as high as 49.

. A price-to-rent ratio of 1 to 15 indicates that buying is more favorable a ratio of 16 to 20 indicates that renting is typically more favorable and a. In general a good DTI to aim for is between 36 and 43. Web Check out the mortgage rates for March 17 2023 which are trending up from yesterday.

To cover that payment youd need to earn a monthly take-home pay of at least 10000 2500 is 25 of 10000. 15-year fixed mortgage rates. So your DTI ratio is 40 since 2800 is 40 of 7000.

Web If youre applying for a USDA loan your front-end ratio should be under 29 percent and your back-end ratio should be below 41 percent. Web For instance a 15-year FHA loan will likely require a credit score of at least 580 down payment of 35 and debt-to-income ratio below 50 just like a 30-year FHA mortgage. Lets say youre applying for a cash-out refinance.

The average rate for a 15-year fixed mortgage is 622 which is a decrease of 11 basis points compared to a week ago. Web 15-year fixed mortgage rates. Web The current average rate on a 15-year mortgage is 622 compared to the rate a week before of 627.

Web If your DTI ratio is higher than the 2836 rule some lenders will still approve you for a loan. The debt-to-income ratio is one. Web Loan to value is the ratio of the amount of the mortgage lien divided by the appraisal value of a property.

Web All that together is 2800. Renting a place can offer more flexibility without the burden of mortgage payments but means you are spending money each month without building any equity. The 52-week high rate for a 15-year mortgage was 632 and the 52-week low was 554.

Rates last updated on Mar. If you put 20 down on a 200000 home that 40000 payment would mean the home still has 160000 of debt against it giving. 10-year fixed mortgage rates.

A basis point is equivalent to. Banking industry according to SP Global Market. An LTV ratio can also help you determine how much cash you might be able to take out with a cash-out refinance which replaces your current mortgage with a larger loan and lets you pocket the extra cash.

Web To calculate your DTI for a mortgage add up your minimum monthly debt payments then divide the total by your gross monthly income. Web For instance SVBs ratio stood at 43 according to the banks mid-quarter update. For VA loans there is no set maximum DTI.

FHFA has decided to delay the effective date of the DTI ratio-based fee by three months to August 1 2023 to ensure a level playing field for all lenders to have. Web If you have some room in your budget a 15-year fixed-rate mortgage reduces the total interest youll pay but your monthly payment will be higher. To find your debt-to-income ratio add up your loan.

Web Rates on 15-year loans climbed similarly gaining nine basis points to reach an average of 625. If an ARM is a good option. Say for instance you pay 350 on.

The 15-year average had sunk as low as 523 on February 2 but compared to the 15-year peak of 7. Youll definitely have a bigger monthly. Web Since the January 2023 announcement FHFA has received feedback from mortgage industry stakeholders about the operational challenges of implementing the DTI ratio-based fee.

Web A 15-year fixed mortgage keeps your rate the same until you either make your final payment at the end of the 15 years or you sell or refinance. Web 30-year fixed-rate mortgages. To get the back-end ratio add up your other debts along with your housing expenses.

The best mortgage lenders. 5490 up from 5375 0115. These rates are based on the assumptions shown.

Web Generally speaking most prospective homeowners can afford to finance a property whose mortgage is between two and two-and-a-half times their annual gross income. That approach will be unrealistic in a number of regional American housing markets with high home prices. Some lenders will go higher but the lower your DTI.

Under this formula a person. Your monthly payment for principal and interest PI would be about 58 greater 839 with the 15-year term 2286 than with a 30-year term 1447. Web Many lenders want this ratio to be less or equal to 36 of the borrowers income.

Web 200000 current loan balance divided by 300000 value 67 current LTV ratio. Web Good luck finding a mortgage in California that you can pay off over a 15-year term with monthly payments at less than 25 of your after-tax income. Web 15-year fixed-rate mortgages.

Web A 15-year mortgage has lower interest costs than a 30-year mortgage not only because the term is half as long but also because the interest rate is usually lower. The average interest rate for a standard 30-year fixed mortgage is 697 which is a decrease of 16 basis points from seven days ago. With a 15-year mortgage at a 5 interest rate your monthly payment would be around 2500 thats only principal and interest.

In mid-2022 the ratio was above 60 across the entire US. It represents the percentage of your monthly gross income that goes to monthly debt payments including your mortgage student loans car payments and minimum credit card payments. Web Each comes with its pros and cons.

If you have a 250 monthly car payment and a minimum credit card payment of 50. 5625 up from 5375 0250. The debt-to-income DTI ratio is a personal finance measure that compares an individuals debt payment to his or her overall income.

Web Debt-To-Income Ratio - DTI.

Iupcn06486tcbm

Home Sales Down 5 8 From Year Ago Amid Tight Inventory Increasing Affordability Challenges And Rising Mortgage Rates Wolf Street

Chancellor S Autumn Statement 2022 Mortgage Support Expanded To Help Those Struggling With Payments

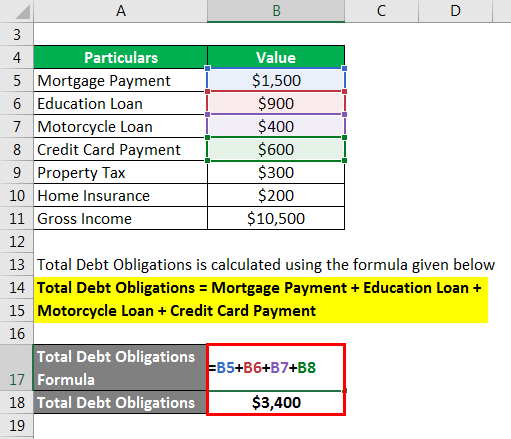

Total Debt Service Ratio Explanation And Examples With Excel Template

What Is A 15 Year Fixed Mortgage Rate Assurance Financial Youtube

Mongolia Mortgage Loans Commercial Banks Cons Oa Hmp 8 Percent Refinanced Mortgage Loan Economic Indicators Ceic

Mortgage Rates Trend Up

Saudi Arabia Percent People With Credit Cards Data Chart Theglobaleconomy Com

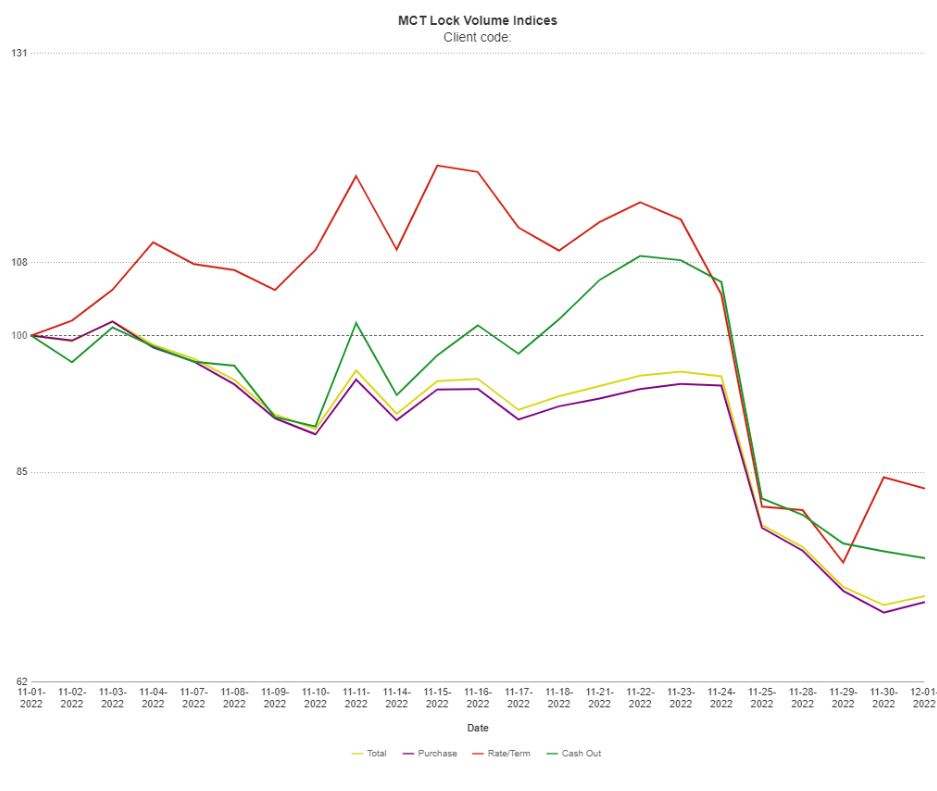

Mct Trading Com Mcttrading Twitter

:max_bytes(150000):strip_icc()/TermDefinitions_llcrfinal-ea7ef85322804a3299b745b301b12083.jpg)

Loan Life Coverage Ratio Llcr Definition Calculation Formula

How To Get A Mortgage With A Great Rate White Coat Investor

The Average Credit Score To Qualify For A Mortgage Is Now Very High

Daily Corona Virus Mortgage Updates Mortgage Broker Vancouver Bc Burnaby Bc Canada

Blog Archives Exaloan

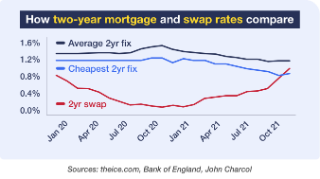

Eight Mortgage Cost Cutting Need To Knows With Interest Rate Rises On The Cards

Ex 99 1

How To Get The Best Mortgage Rate Quicken Loans